proposed federal estate tax changes 2021

A person who operates a gun show must meet certain requirements eg minimum age and registration. Americans are facing a long list of tax changes for the 2022 tax year.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

In December 2017 Congress passed the Tax Cuts and Jobs Act TCJA which greatly changed the way corporations pass-through businesses and individual taxpayers were treated in the tax code.

. Inactive Inspector Status Complaint Form Consumer. Specifically the bill requires the following. Taxable income of 18201 to 45000 19 of excess over 18200.

Gun Show Loophole Closing Act of 2021. No return preparer penalty will be proposed until the estate or gift tax examination is completed at the group level. And a firearm transfer between private parties at a gun show must be.

Contract Changes Presentation TREC Advertisement Rule Review - Whats In A Name Real Estate School Bond Application for Inactive Broker or Sales Agent Status 2022 Purchase Orders and Contracts through 7312022 Advertising Town Hall Presentation Agency Strategic Plan 2023-2027 Application for. Under the Biden administration proposal the 15 minimum tax would apply to the worldwide book income of corporations with such income exceeding 2 billion effective for tax years beginning after December 31 2021. 2022 Tax Policy Outlook.

An election under IRC 754 once made requires that the basis of partnership property be adjusted. The IRS issued final regulations that adopt proposed regulations originally issued in October 2017 without making any changes eliminating the requirement that the election under IRC 754 included with a partnership income tax return be signed by a partner of the partnership. Proposed Changes to Federal DBE Program August 5 2022.

The deal on a reconciliation package announced on July 27 by Senators Chuck Schumer D-NY and Joe Manchin D-WVa would raise an estimated 739 billion in revenue. This document contains proposed amendments to the Income Tax Regulations 26 CFR part 1 under section 401a9. The 2021 Federal budget announced proposed changes to the Disability Tax Credit DTC to broaden its scope and provide more clarity.

President Biden had previously proposed a book income minimum tax as part of his Build Back Better agenda. Taxpayers should be aware that they may soon lose the advantage of long-term capital gain treatment in respect of carried interest should the Inflation Reduction Act of 2022 2022 IRA become law. The federal short-term rate is determined from a one-month average of the market yields from marketable obligations of the United States with maturities of 3 years or less.

The top federal corporate income tax rate fell from 35 percent to 21 percent beginning in 2018. If the estate or gift tax case is unagreed the examiner may pursue the preparer penalty after the unagreed estate or gift tax case is submitted at. Learn how tax plays a key role in your business while the stakes continue to be high in regards to managing potential changes to US and global tax policy.

The territories which have one. Tax Proposals by the Biden Administration. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Estate tax changes appear to be emerging as a broad area of consensus though the Democrats who control the Legislature may differ in their precise approach from what Baker proposed. Proposed rule 2683m would allow a firm to make changes within the review period. These proposed legislative changes are now law with an effective date of January 1 2021.

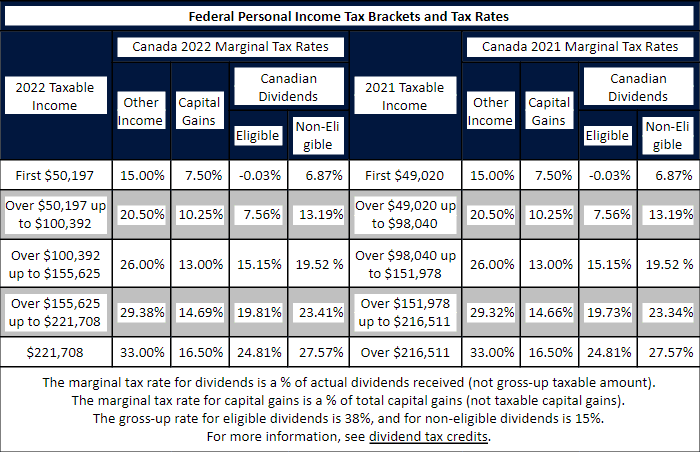

The 20212022 tax rates and income thresholds for residents are therefore unchanged from 20202021. The Disability Tax Credit. A taxpayer has access to the DTC when Canada Revenue Agency CRA formally approves the T2201.

Key Corporate Tax Aspects of the New. The Stage 3 tax changes will commence from 1 July 2024 as previously legislated. This will save applicant firms a great deal of time and headache as well as reduce workloads for the certifiers.

The mid-term rate is determined from obligations with maturities of more than 3 years but not more than 9 years and the long-term rate is determined from. The proposed changes to 478125 would also include a minor amendment to paragraph f to make it clear that in the event the licensee records a duplicate entry with the same firearm and acquisition information whether to close out an old record book or for any other reason the licensee must record a reference to the date and location of. Taxable income up to 18200 nil.

Up to 119 million in 2021 letting the estate value the realty. The Tax Foundation is the nations leading independent tax policy nonprofit. The proposed changes simplify analysis and make commonsense changes for a smoother process.

Were published in the Federal Register on January 6 2021. Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law. Establishes new requirements regarding firearm transfers at gun shows.

Material Changes 1 IRM 4257734 was removed. These proposed regulations include minor changes to existing provisions of 1401a9-9 to conform the terminology in that section to the new. Proposed maps have already been produced in every other province where public feedback has started.

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Biden Tax Plan What People Making Under And Over 400 000 Can Expect

How Progressive Is The Us Tax System Tax Foundation

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Brackets Canada 2022 Filing Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

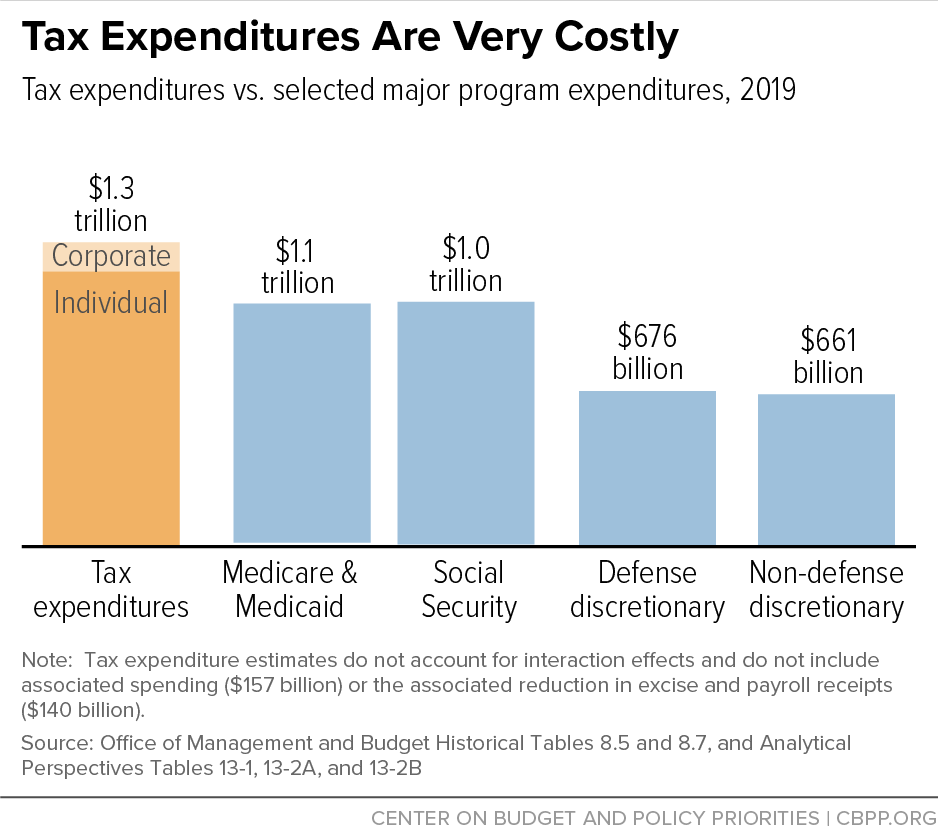

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

How The Tcja Tax Law Affects Your Personal Finances

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

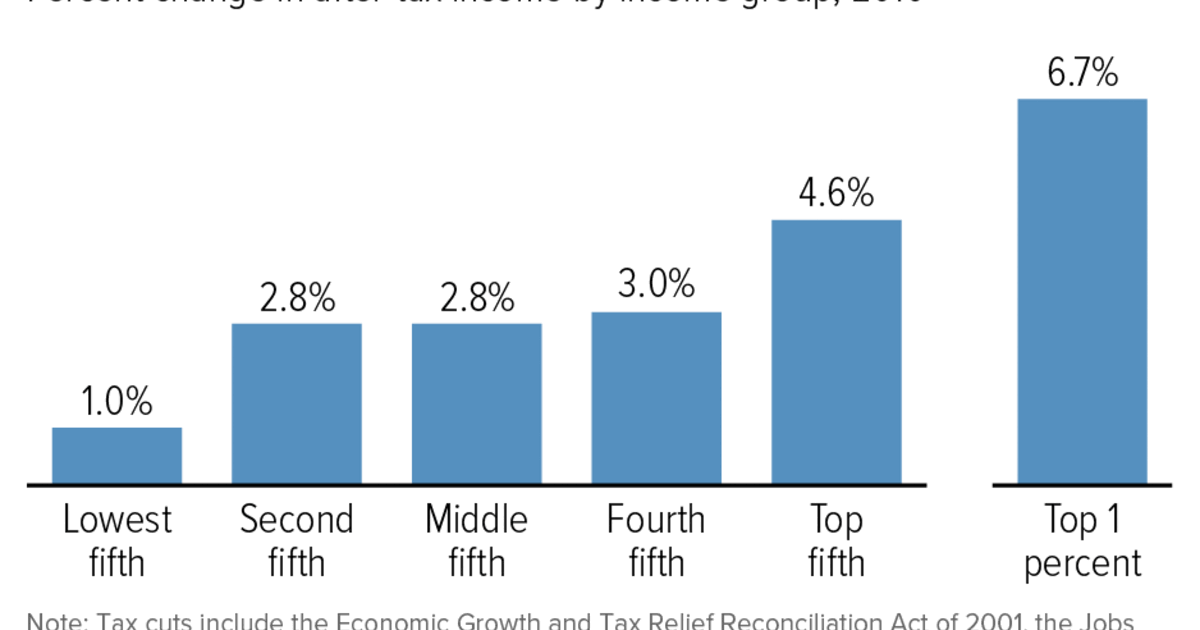

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

How The Tcja Tax Law Affects Your Personal Finances

Doing Business In The United States Federal Tax Issues Pwc

How The Tcja Tax Law Affects Your Personal Finances

How Progressive Is The Us Tax System Tax Foundation

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra